Although exhausting, my travels were incredibly rewarding both in terms of leisure and learning. Adding to the trip's value was the surprising affordability (given the distance traveled). My round-trip nonstop tickets on Iberia to and from Madrid (the starting and ending point for my travels) only cost me 390-dollars.

That's right. 390 dollars, a price within 100 dollars of the price one typically pays to fly to the East Coast in the same season.

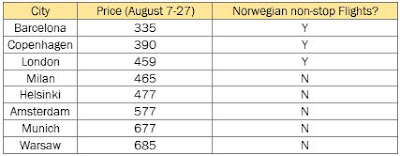

One may think that I encountered an incredibly good stroke of luck (e.g. a last-minute cancellation). But the research I conducted beforehand indicated that my flight was no fluke. When I first researched flights at the beginning of March, round-trip tickets to Barcelona with the same dates were going for only $335 apiece. Multi-city tickets (see Table 2), involving flights into Barcelona at one end, and out of Copenhagen or London at the other end cost only $390 and $459, respectively.

The last time I visited continental Europe, back at the tail-end of the Great Recession, I had to dole out $1,350 for my airfare, with a stop on the way back. What happened?

One of the big break-throughs in transatlantic air travel since my previous visit to Europe has been Norwegian airline's inauguration of low-cost long-haul flights. Using a complex system of contract labor and segmenting responsibilities among various corporate subsidiaries (based in countries with loose regulatory regimes), the airline has cut costs to the point where it can sell non-stop flights from LA to several European cities (Table 1) for as little as $380.

Table 1.Cost of Round-trip Non-stop Flights on Norwegian Airlines from Los Angeles to European Destinations

Interestingly, the three bargain origin-destination pairs I discovered in March (i.e. Barcelona-Barcelona, Barcelona-London and Barcelona-Copenhagen) incorporated cities with non-stop, year-round Norwegian service on both ends (Table 2). By contrast, when I looked at returning from cities which lacked non-stop Norwegian service (maintaining Barcelona as the point of entry) I found the round-trip fares considerably more expensive: returning from Amsterdam or Munich increased the flight cost to nearly $600 or 700$, respectively (Table 2).

Table 2. Comparison of Flight Costs to cities with and without Norwegian Service for the dates August 8-27, 2019

Could it be that Norwegian was driving down fares through its competitive pricing?

To tackle this question in depth, I compared airfares from Los Angeles to several European cities for the dates of April 8-15, 2020 (see Table 3). Four of the cities have Norwegian service and four do not. Cities were selected so that each city with Norwegian service was located in the same general geographic region of Europe as a city without Norwegian service. This would control for the influence of geographic factors on air pricing trends. I limited the analysis to cities that I knew to be major air travel hubs (all of the cities' primary airports rank among the 20 busiest in Europe-and are thus less susceptible to influence by a particular airline cutting or adding service) and that had non-stop service from Los Angeles.

Table 3. Comparison of Flight Costs for Week of April 8 to 15 for Destinations with and without Norwegian Service

Across all four regions, cities with Norwegian service had a lower-priced roundtrip ticket than cities without Norwegian service (with the absolute price difference ranging from $29 to $222). Indeed, performing a Student's T-Test on the average price difference for the sampled dates, shows that there is only a two percent probability that the average price for cities with Norwegian service is equal to or greater than the average price for cities without Norwegian service (Table 4). At a 95 percent confidence interval (as is standard in statistics), the difference between the average prices is statistically "significant." In other words, there is substantial enough variation for the sampled dates to conclude that the actual mean price for flights to and from cities with Norwegian service is lower than the actual mean price for cities without Norwegian service.

Table 4. Student's T-Test, Norwegian and Non-Norwegian Cities

Wonkiness aside, this finding has important implications for air travel and urban economics. It provides yet further evidence that the entry of low-cost airlines into a market drives down the price of flying into that market for all consumers (regardless of whether they actually fly on the airline). It suggests that the price of a flight has as much to do with competition as with the actual inputs (primarily jet fuel) of travel (flying from LA to Dublin involves slightly less fuel expenditure than flying from LA to London, yet costs more because the market is more constrained). Indeed, flights from Los Angeles to several mid-sized destinations in the eastern US, including Charlotte, NC and Albany, NY, were priced within $100 of the flights to the Norwegian destinations in Europe.

Urban and Regional Economics has recently taken an interest in the divergence between America's "superstar," knowledge-economy cities along the coasts and struggling blue-collar cities in the Rust Belt. Many factors beyond the scope of this paper could account for these disparities, but the pricing of access from the coast to the heartland at levels equal to or higher than access from the coast to Europe certainly impedes the ability of residents in the latter cities to connect with the human capital and resources of the latter. Therefore, these findings raise important questions regarding how air connections impact the development of "city-systems" both nationally and internationally.

No comments:

Post a Comment